In the heart of India’s Silicon Valley, Bengaluru, Kunal Shah’s journey to founding and nurturing CRED into a unicorn was a remarkable blend of innovation, tenacity, and a relentless pursuit of excellence.

Kunal’s story began with an entrepreneurial spirit that burned brightly within him. Armed with a degree in philosophy and an inherent knack for identifying unmet consumer needs, he embarked on a journey that would eventually lead to the creation of CRED. Before CRED, Kunal had already made his mark in the startup ecosystem as the co-founder of FreeCharge, an online mobile recharge platform.

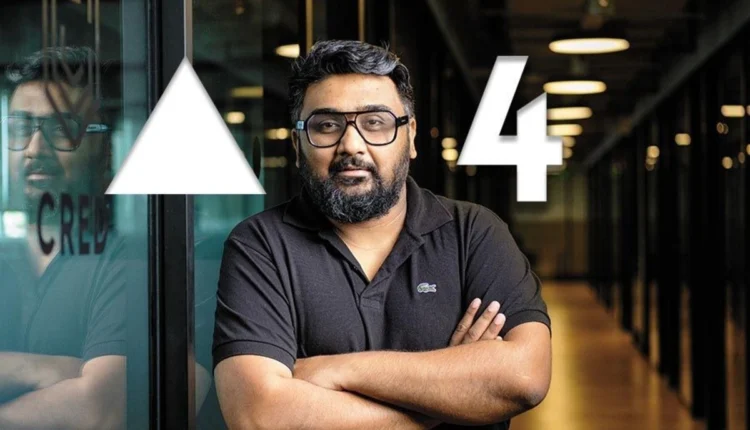

Kunal Shah’s Journey and Achievements

FreeCharge was a resounding success, and Kunal’s entrepreneurial journey was off to a great start. However, his desire to push the boundaries of what technology and innovation could achieve was insatiable. Kunal envisioned a new project, one that would not just address a specific need but would redefine an entire industry.

The idea behind CRED was to reward individuals for responsible credit behavior while simultaneously providing a platform for seamless credit card bill payments. Kunal aimed to make financial management effortless, delightful, and rewarding. He saw an opportunity to disrupt the traditional credit card industry in India, which was often seen as cumbersome and frustrating by users.

CRED’s journey was not without its share of hurdles. To transform his vision into a reality, Kunal had to secure substantial funding. He understood the potential of CRED but needed investors who shared his vision and were willing to bet on his innovative approach. After numerous pitches and rejections, he finally found investors who recognized the transformative power of CRED and backed his idea.

CRED’s launch was met with anticipation and curiosity. It was a platform that not only simplified credit card bill payments but also offered users a unique rewards system. Members were incentivized for responsible credit behaviour, which included paying bills on time and maintaining a healthy credit score.

The rewards, ranging from discounts to exclusive offers, caught the attention of users. Kunal’s innovative approach was paying off, and CRED quickly gained popularity among credit cardholders. It not only simplified financial management but also made it an engaging and rewarding experience.

The turning point came when CRED introduced the concept of CRED Coins, a digital currency that could be earned and spent on various services and products. This gamification element added a layer of excitement and competitiveness, driving more users to the platform. Kunal’s innovative thinking and constant drive for improvement were propelling CRED toward unicorn status.

Kunal’s dedication to excellence extended beyond the app’s features. He ensured that CRED’s customer service was impeccable, setting new industry standards. He believed in nurturing a sense of trust and security among users, ensuring that CRED was not just a service but an experience that people could rely on.

The year 2021 marked a significant milestone for Kunal and CRED as the company achieved unicorn status, attaining a valuation of over $1 billion. Kunal’s innovative approach and unyielding work ethic had borne fruit, and CRED became one of India’s most prominent fintech companies.

Kunal Shah‘s journey with CRED is a testament to the power of innovation and hard work. It exemplifies how a relentless pursuit of excellence can transform an industry and create a paradigm shift in consumer behavior. CRED, under Kunal’s leadership, has not only simplified credit management but has made it an engaging, rewarding, and delightful experience.

Kunal Shah’s story is an inspiration to budding entrepreneurs and innovators, demonstrating that with the right idea, a passionate team, and unwavering dedication, it is possible to create a game-changing product that resonates with users and changes the business landscape forever. Kunal Shah’s vision for CRED has not just made financial management easier but also turned it into a truly rewarding experience.

Also Read : Rajan Bajaj: Pioneering the Slice of Credit Revolution